When it comes to fast-changing areas of legal practice, Tax Law sits at the top of the list. This is a complex and increasingly competitive field for firms looking to grow their business. As clients search online for help with everything from business tax issues and personal tax challenges to audits and IRS disputes alike, you want your firm to turn up as the first-choice solution online. At Blue Media Marketing Law, we’re here to help implement tax law firm SEO that can truly change the way you work. With this strategy in place, you can watch your website rise above the competition when it comes to attracting more qualified leads. SEO for tax attorneys is a great way to position your practice as a trusted authority in a specialized field so you can provide those who need you most with the quality services they deserve.

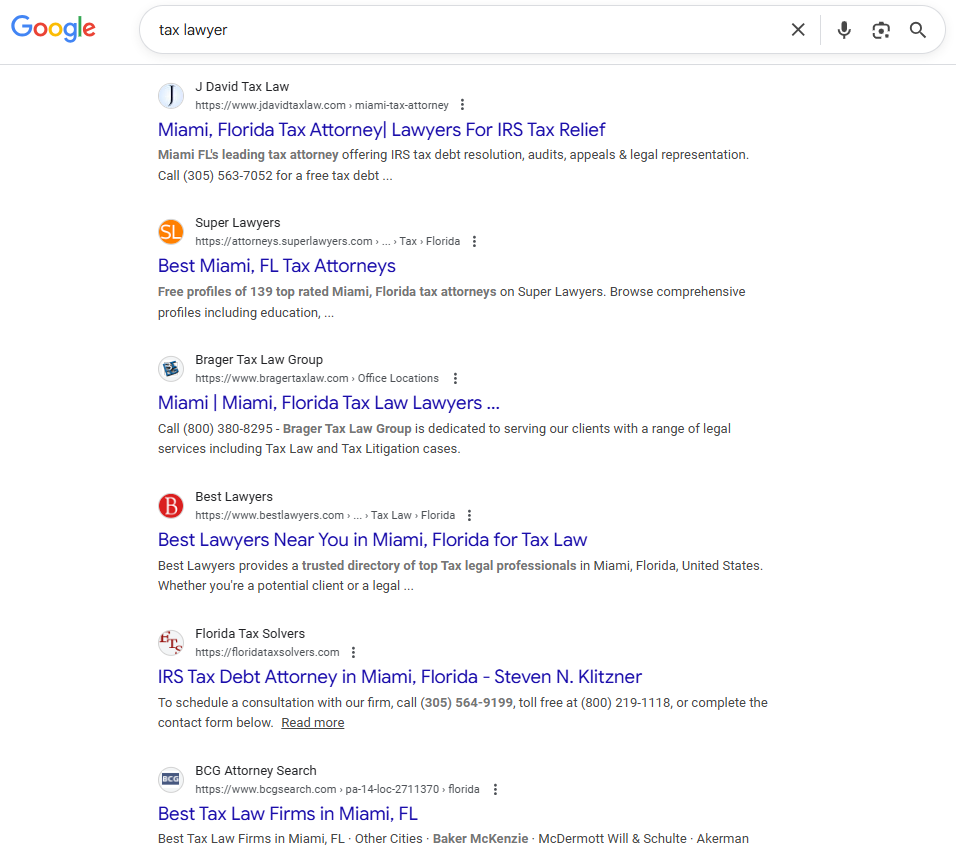

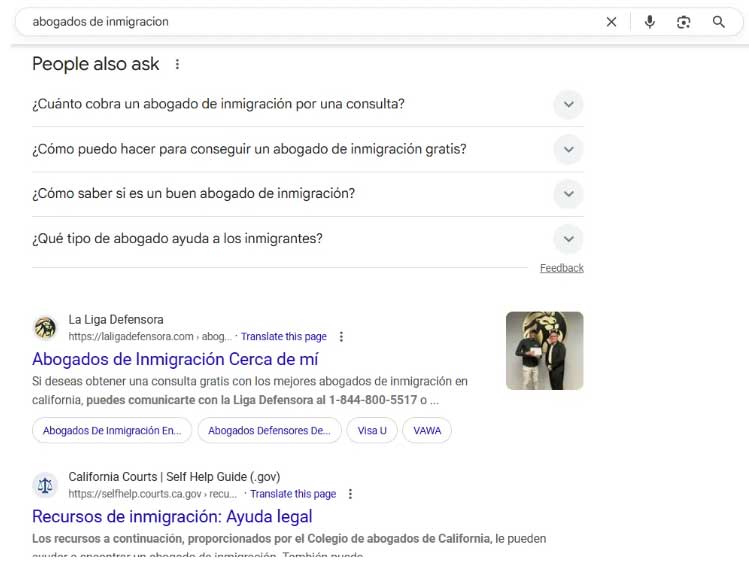

Partnering with our team at Blue Media Marketing Law is an incredible opportunity to optimize your firm’s website with strategic SEO in place. This means your firm will appear closer to first in the lineup of search results that are specific to tax issues. Blue Media Marketing Law helps tax law firms grow by creating customized digital marketing strategies that focus on tax-specific terminology. We approach tax law SEO with a clear understanding of how clients search for answers to questions regarding tax resolution and controversy online. Once we’ve optimized your website for national and local tax-related searches through strategic keywords and phrases, we’ll begin adding more robust content that explains complicated tax topics in easy-to-understand language. This is extra appealing to prospective clients and also builds authority through your site, confirming your firm is a reputable legal source for those seeking answers in real time.

As the world of Tax Law becomes increasingly more competitive, staying a step ahead begins with having a strategic digital marketing plan in place. At Blue Media Marketing Law, that’s exactly what we provide, and so much more. We know that your clients are relying on online research for tax answers. To that end, our goal is to create a digital marketing plan that’s customized to your specialty and moves them in your firm’s direction for guidance with every online search. When we create a digital presence for your firm, it builds authoritative trust in the online community and can successfully reach clients in the very moment they’re looking for tax-related answers. That means more relevant leads heading your way, and higher potential for converting those leads into long-lasting clients. A pointed digital marketing strategy improves your firm’s visibility across local, regional, and national tax resolution searches, expanding your reach and top place among competitors.

At Blue Media Marketing Law, our team of experts understands that successful SEO begins with a clear understanding of what clients are searching for online. When your tax firm partners with us, we’ll take time to carefully research terms related to everything from wage garnishment and tax liens to IRS audits, tax penalties, appeals, business tax disputes, and more. This approach allows us to clearly target relevant phrases your clients use when seeking legal support, and direct them to your site before others come up in additional search results. Additionally, we prioritize building consistent local citations into your website, as well as creating city-specific service pages for clients to browse, helping you stand out as an expert in your field. Our goal is always to create content that answers the top questions your clients want answered in a way that’s easy-to-read and understandable. This could include guides on how to respond to IRS notices, articles explaining common tax issues, or blog posts addressing those ever-changing IRS updates.

This is content that makes your site trustworthy, reliable, and a go-to for legal support of all kinds. At Blue Media Marketing Law, we know how to seamlessly integrate backlinks into your website for easy navigation and create a space that’s defined by fast load speeds, mobile-friendly designs, and secure HTTPS connections as well. All of these elements combined ensure search engines will find your site with ease, and showcase it first, improving your overall visibility online.

A data-driven SEO strategy is exactly what your tax firm deserves to have in place when you want to see meaningful and measurable growth. That’s exactly what we deliver at Blue Media Marketing Law. Our targeted approach to digital marketing is tailored to the urgency your clients feel when they’re dealing with IRS issues and need legal help quickly. We’ll make sure that your SEO and marketing plan revolves around your firm’s priorities and the market you’re hoping to reach. Whether you focus on tax litigation, general tax resolution, audits, or business disputes, we’ll provide transparent reporting so you can always know how your SEO is performing. With access to case studies, lead generation data, website traffic numbers, and keyword rankings, you’ll be in the loop every step of the way as your website rises to the top of search lists everywhere.

There’s no reason to wait when you’re ready to take your tax law firm to the next level of success. Reach out to Blue Media Marketing Law today to learn more about our strategic approach to tax law SEO and how it can help you remain successful in a competitive marketplace.

SEO Specialists With 20+ Years of SEO Strategy, Implementation & Data Analysis Experience.

Intro Call &

Mutual Fit

Discovery &

Competitor Review

Custom

Proposal

SEO Execution &

Results

When you integrate SEO, you effectively highlight your legal authority as well as your unique services through specific terminology that tax relief companies and CPAs simply don’t provide. This could be anything from appeals and legal representation to litigation that sets your firm apart.

At Blue Media Marketing Law, we find that balance works best. That’s because IRS-related terms have a way of attracting high-value cases, while local searches typically result in a steady influx of leads for firms.

While it can vary depending on your firm’s tax specialty, high-intent terms related to levies, liens, audits, and IRS notices often lead to high conversion rates across the board.

Absolutely. When you include authoritative and in-depth content on your site, you signal to clients that you’re an expert in the field. This simultaneously indicates to search engines that you’re qualified to rank for advanced tax topics online.

On average, tax firms we work with begin to see meaningful growth within three to six months of implementing an SEO campaign of this kind.